Differences between Trump- and Clinton-Tax-Plan

Contents

2016 presidential election tax proposals[edit]

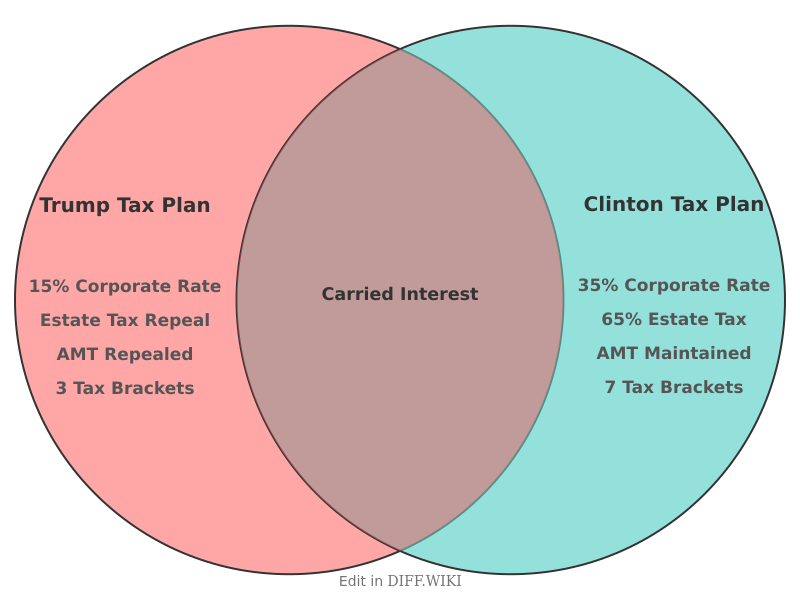

During the 2016 United States presidential election, Donald Trump and Hillary Clinton presented different approaches to federal tax policy. The proposals reflected a choice between supply-side economics, which prioritizes broad tax cuts to encourage investment, and progressive taxation, which seeks to increase revenue from high-income earners to fund social programs and reduce the deficit.

Donald Trump's plan centered on a significant reduction in both individual and corporate tax rates. He proposed consolidating the existing seven individual income tax brackets into three, with a top rate of 33%.[1] A central feature of his proposal was the reduction of the corporate income tax rate from 35% to 15%. Trump also called for the elimination of the estate tax and the Alternative Minimum Tax (AMT). His campaign argued these changes would simplify the tax code and stimulate domestic economic growth.

Hillary Clinton's plan focused on increasing taxes for the wealthiest Americans while maintaining or expanding credits for middle- and lower-income families. She proposed a 4% "fair share surcharge" on taxpayers with an adjusted gross income exceeding $5 million.[2] Clinton also supported the "Buffett Rule," which established a 30% minimum effective tax rate for individuals earning more than $1 million annually. Her plan included an expansion of the estate tax, raising the top rate to 65% for the largest estates, and modifications to capital gains taxes to encourage longer-term investments.

Comparison table[edit]

| Category | Donald Trump's 2016 proposal | Hillary Clinton's 2016 proposal |

|---|---|---|

| Individual tax brackets | Three brackets: 12%, 25%, and 33% | Seven brackets (existing) with a 4% surcharge on top earners |

| Corporate tax rate | Reduced from 35% to 15% | Maintained at 35% with new "exit taxes" for inversions |

| Estate tax | Full repeal | Increased top rate to 65%; lowered exemption threshold |

| Capital gains tax | Top rate of 20% (existing) | Sliding scale based on holding period (up to 39.6% for short-term) |

| Alternative Minimum Tax | Repealed | Maintained |

| Childcare incentives | Deduction for average cost of childcare | Tax credit expansion for low-to-middle income families |

| Carried interest | Taxed as ordinary income | Taxed as ordinary income |

Economic analysis[edit]

Non-partisan organizations analyzed the fiscal impact of both plans during the campaign. The Tax Policy Center estimated that the Trump plan would reduce federal revenue by approximately $6.2 trillion over ten years, potentially increasing the national debt if not offset by spending cuts or higher-than-expected economic growth.[1] Conversely, the Tax Foundation estimated that the Clinton plan would increase federal revenue by roughly $1.4 trillion over the same period, primarily through higher taxes on capital and high earners.[2]

The candidates also differed on business taxation beyond the headline rates. Trump proposed a "repatriation" tax of 10% on corporate profits held overseas to encourage companies to return capital to the U.S.[3] Clinton proposed closing loopholes that allowed companies to move their headquarters abroad for tax purposes, a practice known as corporate inversion.

References[edit]

- ↑ 1.0 1.1 Tax Policy Center. "An Analysis of Donald Trump's Revised Tax Plan." October 11, 2016.

- ↑ 2.0 2.1 Tax Foundation. "Details and Analysis of Hillary Clinton’s Tax Proposals." October 2016.

- ↑ Committee for a Responsible Federal Budget. "Promises and Price Tags: A Fiscal Guide to the 2016 Election." September 2016.