Differences between Itemized Deduction and Standard Deduction

Contents

Comparison Article[edit]

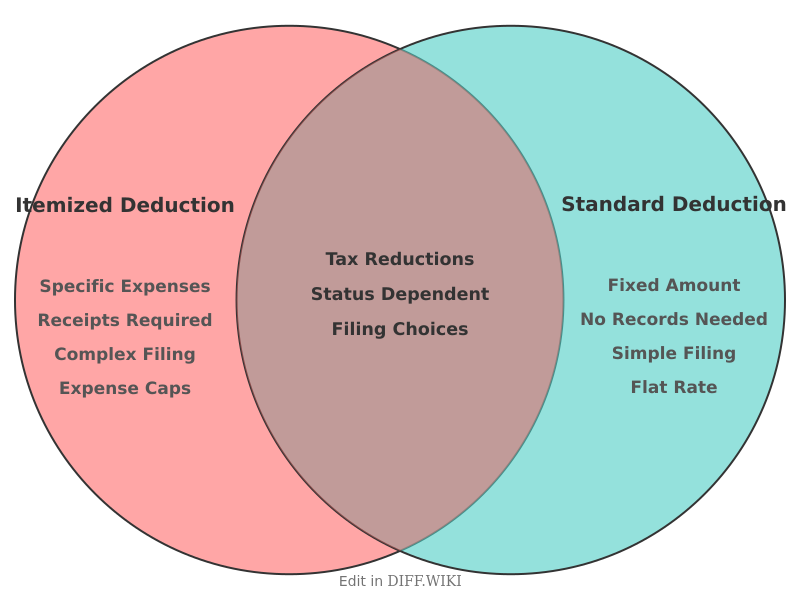

In the United States federal income tax system, taxpayers reduce their taxable income by claiming either a standard deduction or itemized deductions. The standard deduction is a fixed dollar amount based on filing status that reduces the income subject to tax. Itemized deductions allow taxpayers to list specific expenses incurred during the year, such as mortgage interest or charitable gifts, to lower their tax liability. According to the Internal Revenue Service (IRS), most taxpayers claim the standard deduction because it is higher than their total itemizable expenses.[1]

Comparison of deduction methods[edit]

| Category | Standard deduction | Itemized deductions |

|---|---|---|

| Definition | A fixed dollar amount based on filing status. | A list of specific qualified expenses. |

| Documentation | No receipts or records required for the deduction itself. | Requires receipts, invoices, and detailed records. |

| Ease of filing | Simple; requires no additional forms. | Complex; requires filing Form 1040, Schedule A. |

| Impact of filing status | Highly dependent on status (e.g., Single vs. Married). | Based on actual spending regardless of status. |

| Expense limits | Not applicable. | Subject to various caps (e.g., the $10,000 SALT cap). |

| Common examples | None (flat rate). | Mortgage interest, state taxes, medical bills. |

| Selection criteria | Best when expenses are below the fixed threshold. | Best when total expenses exceed the standard amount. |

Standard deduction[edit]

The standard deduction is adjusted annually to account for inflation. For the 2025 tax year, the amounts are $15,000 for single filers and $30,000 for married couples filing jointly.[2] This method does not require taxpayers to track individual spending or maintain records of specific costs.

The Tax Cuts and Jobs Act of 2017 (TCJA) nearly doubled the standard deduction, which resulted in a decrease in the number of households that choose to itemize. Prior to this legislation, approximately 30 percent of taxpayers itemized; following the change, that figure dropped to roughly 10 percent.[3]

Itemized deductions[edit]

Taxpayers who choose to itemize must provide evidence for each expense claimed. Common categories include:

- State and local taxes (SALT): Taxpayers may deduct state and local income or sales taxes, plus property taxes, up to a combined limit of $10,000.

- Mortgage interest: Interest paid on up to $750,000 of mortgage debt for a primary or secondary home is generally deductible.

- Charitable contributions: Donations to qualified non-profit organizations are deductible, though limits apply based on adjusted gross income (AGI).

- Medical expenses: Unreimbursed medical and dental costs are deductible only to the extent they exceed 7.5 percent of the taxpayer's AGI.

Itemizing is more common among taxpayers with high income, large mortgages, or significant medical costs. If a married couple files separate returns, both must choose the same method; if one person itemizes, the other cannot claim the standard deduction.[4]

References[edit]

- ↑ Internal Revenue Service. (2024). "Standard Deduction vs. Itemized Deductions." IRS.gov.

- ↑ Tax Foundation. (2024). "2025 Tax Brackets and Federal Income Tax Rates." TaxFoundation.org.

- ↑ Tax Policy Center. (2020). "How did the TCJA affect the standard deduction and itemized deductions?" Brookings.edu.

- ↑ Department of the Treasury. (2024). "Publication 17: Your Federal Income Tax." IRS.gov.