Differences between Income and Revenue

Revenue vs. Income[edit]

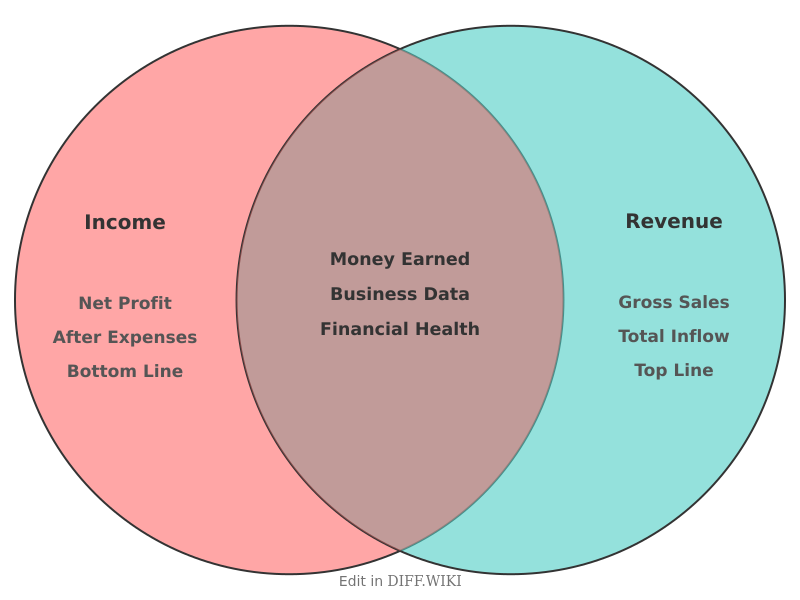

Revenue and income are fundamental financial metrics used in accounting to evaluate the performance of a business or the financial status of an individual. While the terms are frequently used in related contexts, they represent different stages of the financial reporting process. Revenue represents the total amount of money generated by a company's primary operations before any expenses are subtracted. Income, specifically net income, refers to the profit that remains after all operational costs, taxes, interest, and other expenses have been deducted from the total revenue.

In corporate accounting, revenue is often called the "top line" because it appears at the top of an income statement. It includes all receipts from the sale of goods and services, as well as interest, royalties, or fees. For a business to be sustainable, it must generate sufficient revenue to cover its costs. However, high revenue does not always equate to profitability. A company may report substantial revenue while incurring even higher expenses, resulting in a net loss.

Income is categorized as the "bottom line." It provides a clearer picture of financial health by showing the actual wealth generated during a specific period. Businesses often distinguish between several levels of income, such as gross profit, operating income, and net income. Gross profit is revenue minus the cost of goods sold (COGS). Operating income further subtracts administrative and selling expenses. Net income is the final figure after accounting for all remaining costs, including taxes and interest payments.

Comparison Table[edit]

| Category | Revenue | Income (Net) |

|---|---|---|

| Position on Statement | Top line of the income statement. | Bottom line of the income statement. |

| Basic Calculation | Price per unit × Number of units sold. | Total Revenue − Total Expenses. |

| Focus | Sales and business volume. | Profitability and efficiency. |

| Dependency | Independent of the company's cost structure. | Directly dependent on revenue and cost management. |

| Business Synonyms | Gross sales, turnovers, receipts. | Net profit, earnings, the bottom line. |

| Individual Context | Gross salary or total wages before taxes. | Disposable income or take-home pay. |

| Significance | Indicates market demand and growth. | Indicates the ability to pay dividends or reinvest. |

For individuals, the distinction between these terms usually pertains to salary and tax obligations. An individual’s "gross income" is effectively their revenue, representing the total amount earned from employers or investments. Their "net income" is the amount remaining after federal, state, and local taxes, as well as health insurance and retirement contributions, are withheld.

Accounting standards such as the Generally Accepted Accounting Principles (GAAP) in the United States and the International Financial Reporting Standards (IFRS) provide specific rules for when revenue and income must be recognized. Under the accrual method of accounting, revenue is recognized when it is earned, regardless of when the cash is actually received. Income is then calculated by matching the expenses incurred to the revenue generated in the same period, a practice known as the matching principle.

References[edit]

- ↑ Financial Accounting Standards Board. (2021). "Statement of Financial Accounting Concepts." FASB.org.

- ↑ IFRS Foundation. (2014). "IFRS 15: Revenue from Contracts with Customers." International Accounting Standards Board.

- ↑ Corporate Finance Institute. (2023). "Revenue vs Income: A Comprehensive Guide." CorporateFinanceInstitute.com.

- ↑ Investopedia. (2024). "Revenue vs. Income: What's the Difference?" Investopedia.com.