Differences between HMO and PPO

HMO vs. PPO[edit]

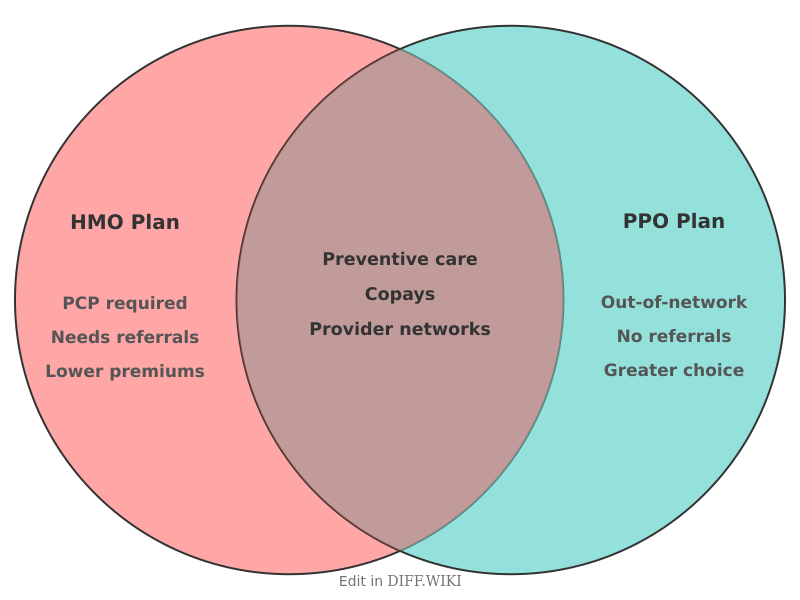

Health maintenance organizations (HMO) and preferred provider organizations (PPO) are the two most common structures for managed healthcare insurance in the United States. Both systems use a network of providers to manage the cost of medical services, but they utilize different administrative requirements and cost-sharing models. The choice between these plans involves a trade-off between the monthly cost of the insurance and the flexibility allowed in selecting healthcare professionals.

In an HMO, coverage is generally limited to care from doctors who work for or contract with the organization.[1] Patients are required to choose a primary care physician (PCP) to coordinate all medical care. This physician acts as a gatekeeper for specialized services. If a patient needs to see a specialist, the PCP must first provide a formal referral. Services obtained from out-of-network providers are typically not covered by the insurance plan, meaning the patient must pay the full cost out of pocket, except in the case of a medical emergency.

A PPO provides more flexibility by allowing participants to visit any healthcare provider in their network without a referral from a primary care physician. Participants in a PPO may also seek care from providers outside of the network. While the insurance company will pay a smaller percentage of the bill for out-of-network care than for in-network care, the existence of this coverage distinguishes PPOs from HMOs. This increased freedom and lack of referral requirements usually result in higher monthly premiums and higher out-of-pocket costs for the consumer.[2]

Comparison table[edit]

| Category | HMO | PPO |

|---|---|---|

| Primary Care Physician (PCP) | Required | Not required |

| Specialist referrals | Required from PCP | Not required |

| Out-of-network coverage | None (except emergencies) | Partial coverage provided |

| Monthly premiums | Typically lower | Typically higher |

| Deductibles | Often low or non-existent | Often higher |

| Claims filing | No paperwork for the patient | Patient may need to file out-of-network claims |

| Network size | Smaller, more restrictive | Larger, more inclusive |

| Cost-sharing (Copays) | Predictable, fixed amounts | Variable based on provider status |

Cost and network structures[edit]

HMOs focus on integrated care and prevention. By requiring a primary care physician to manage a patient's medical history, the plan aims to reduce redundant testing and unnecessary specialist visits. This structure allows the insurer to negotiate lower rates with a specific group of providers. Because of these efficiencies, HMOs often have no deductible or very low copayments for office visits.[3]

PPOs cater to individuals who prefer to manage their own healthcare or who have established relationships with specific specialists. The PPO model uses a "preferred" list of doctors, but it does not restrict the patient to that list. When a patient chooses a provider who is not on the preferred list, the insurance company pays a lower percentage of the "allowed amount" for that service. The patient is then responsible for the remainder of the bill, which can lead to significantly higher expenses for out-of-network care.[4]

References[edit]

- ↑ Centers for Medicare & Medicaid Services. "Glossary of Health Coverage and Medical Terms." Accessed February 18, 2026.

- ↑ Healthcare.gov. "Health maintenance organization (HMO)." Accessed February 18, 2026.

- ↑ National Association of Insurance Commissioners. "Managed Care." Accessed February 18, 2026.

- ↑ U.S. Department of Labor. "Health Plans & Benefits: Patient Protections." Accessed February 18, 2026.