Differences between Community Property and Separate Property

Contents

Community property vs. separate property[edit]

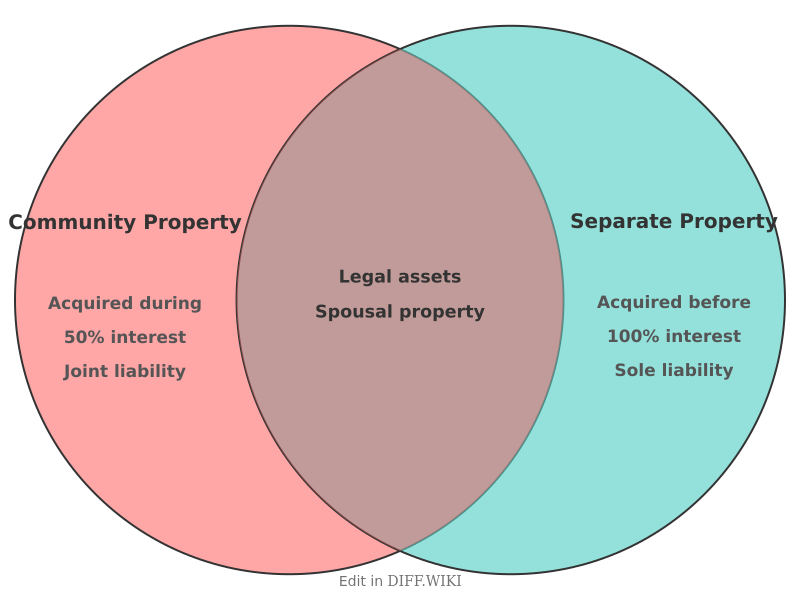

In the United States, the division of assets and debts between spouses is governed by state law, falling into two primary categories: community property systems and common law (separate property) systems. Nine states—Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin—currently operate under community property regimes, while Alaska and Tennessee allow couples to opt into such systems.[1] The distinction determines how property is managed during marriage and how it is divided upon divorce or the death of a spouse.

Community property is defined as any asset acquired by either spouse during the marriage, regardless of which spouse earned the income or whose name is on the title. Under this legal framework, each spouse owns an undivided one-half interest in all community assets. In contrast, separate property consists of assets owned by one spouse individually. This usually includes property owned prior to the marriage or assets received as a gift or inheritance specifically directed to one person rather than the couple.[2]

Comparison table[edit]

| Category | Community Property | Separate Property |

|---|---|---|

| Acquisition Timing | Assets acquired during the marriage. | Assets acquired before marriage or after legal separation. |

| Ownership Interest | Each spouse owns a 50% interest. | Owned 100% by the individual spouse. |

| Income from Asset | Usually considered community property. | Usually remains separate property. |

| Inheritances and Gifts | Generally excluded unless given to both. | Remains separate even if received during marriage. |

| Debt Liability | Both spouses may be liable for "community" debts. | Only the spouse who incurred the debt is typically liable. |

| Division at Divorce | Typically split 50/50 between spouses. | Retained by the original owner. |

| Control and Management | Both spouses often have equal management rights. | Managed solely by the owner-spouse. |

| Death of a Spouse | Decedents can only bequeath their 50% share. | Decedents can bequeath 100% of the asset. |

Commingling and transmutation[edit]

The status of property can change through actions taken by the spouses. Commingling occurs when separate property is mixed with community property to the extent that the original separate asset can no longer be traced. For example, if a spouse places an inheritance into a joint bank account used for daily household expenses, a court may determine the entire account has become community property.[3]

Transmutation refers to a formal agreement to change the character of property. This is often done through prenuptial or postnuptial agreements where spouses specify that certain community assets will be treated as separate property, or vice versa. In most jurisdictions, transmutation requires a written declaration that is signed by the spouse whose interest in the property is adversely affected.[4]

Debt and liability[edit]

Liability for debts follows similar logic to the division of assets. In community property states, debts incurred during the marriage for the benefit of the family—such as mortgages or credit card debt for household goods—are generally the responsibility of both partners. Separate property is usually protected from the creditors of the other spouse, provided the assets have not been commingled. If community funds are used to pay off a separate debt, such as a pre-marital student loan, the community may be entitled to reimbursement during divorce proceedings.

References[edit]

- ↑ IRS. "Publication 555 (03/2020), Community Property." Internal Revenue Service. Accessed February 15, 2026.

- ↑ Cornell Law School. "Community Property." Legal Information Institute. Accessed February 15, 2026.

- ↑ California Family Code § 760–772.

- ↑ Texas Family Code, Title 1, Chapter 3. "Marital Property Rights and Liabilities."