Differences between Certificate of Deposit and Money Market Account

Contents

Certificate of deposit vs. money market account[edit]

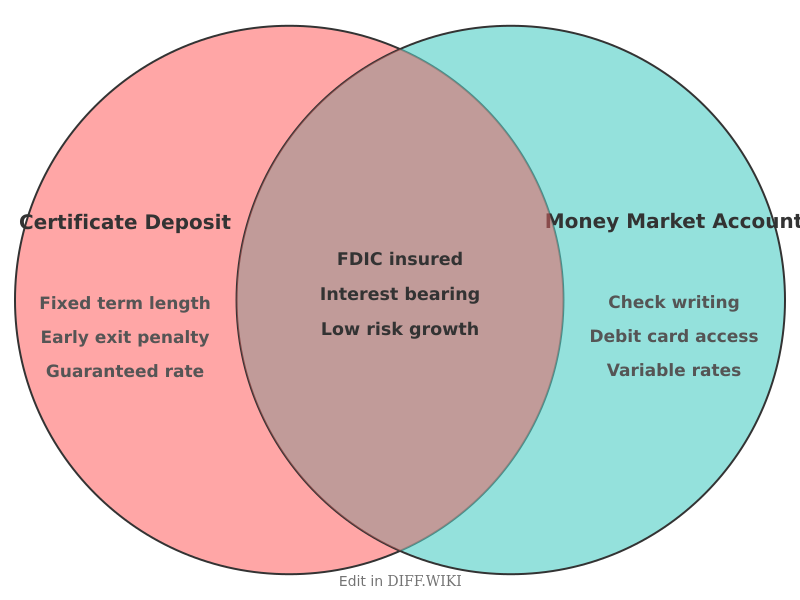

A certificate of deposit (CD) and a money market account (MMA) are interest-bearing deposit accounts offered by banks and credit unions. Both products provide a way for individuals to earn interest on cash while maintaining a high degree of safety for the principal amount. In the United States, these accounts are typically insured up to $250,000 per depositor by the Federal Deposit Insurance Corporation (FDIC) for banks or the National Credit Union Administration (NCUA) for credit unions [1]. While they serve similar purposes, they differ in terms of liquidity, interest rate structures, and fund access.

Comparison of features[edit]

| Category | Certificate of deposit (CD) | Money market account (MMA) |

|---|---|---|

| Term length | Fixed period (e.g., 6 months to 5 years) | No fixed term |

| Interest rate | Usually fixed for the term | Variable; changes with market |

| Fund access | Limited; maturity date required | Checks, debit cards, and ATMs |

| Early withdrawal | Penalty of several months' interest | No penalty; monthly transaction limits |

| Minimum deposit | Varies by institution and term | Often higher than standard savings |

| Liquidity | Low; funds are locked | High; accessible at any time |

| Best use | Long-term savings with a set goal | Emergency funds or accessible savings |

Liquidity and access[edit]

A primary difference between the two accounts is how a depositor can access their money. A certificate of deposit is a time deposit. When an account is opened, the depositor agrees to leave a specific sum of money in the account for a predetermined period. This period is known as the term. Accessing these funds before the term expires results in an early withdrawal penalty [2]. This penalty is usually calculated as a specific amount of interest, such as 90 or 180 days of earnings.

A money market account functions more like a hybrid between a checking and a savings account. It does not have a fixed term, and the account holder can add or remove funds as needed. Most financial institutions provide check-writing privileges, debit cards, and ATM access for money market accounts. However, these accounts may be subject to limits on "convenient" transfers or withdrawals. Until 2020, federal Regulation D limited these transactions to six per month. Although the federal government suspended this requirement, many banks continue to enforce a six-transfer limit and charge fees for exceeding it [3].

Interest rate structures[edit]

The method of calculating interest differs between these two products. A CD typically offers a fixed interest rate. Once the account is opened, the rate remains the same until the maturity date. This provides the depositor with a predictable return, even if market interest rates decrease. However, if market rates increase, the depositor is locked into the lower rate unless they pay a penalty to close the account early.

Money market accounts utilize variable interest rates. The bank or credit union adjusts the rate periodically based on current economic conditions and the federal funds rate. If interest rates rise, the yield on an MMA increases automatically. Conversely, the yield will drop if the institution lowers its rates. Because MMAs offer more flexibility and access to funds, their interest rates are often lower than those offered for long-term CDs [4].

References[edit]

[1] Federal Deposit Insurance Corporation. "Deposit Insurance At A Glance." FDIC.gov. [2] Consumer Financial Protection Bureau. "What is a certificate of deposit (CD)?" Consumerfinance.gov. [3] Board of Governors of the Federal Reserve System. "Federal Reserve Board announces interim final rule to amend Regulation D." Federalreserve.gov. [4] Office of the Comptroller of the Currency. "Withdrawing Money from Your Certificate of Deposit." HelpWithMyBank.gov.