Differences between CD- and Savings-Account

Contents

Certificate of deposit vs. savings account[edit]

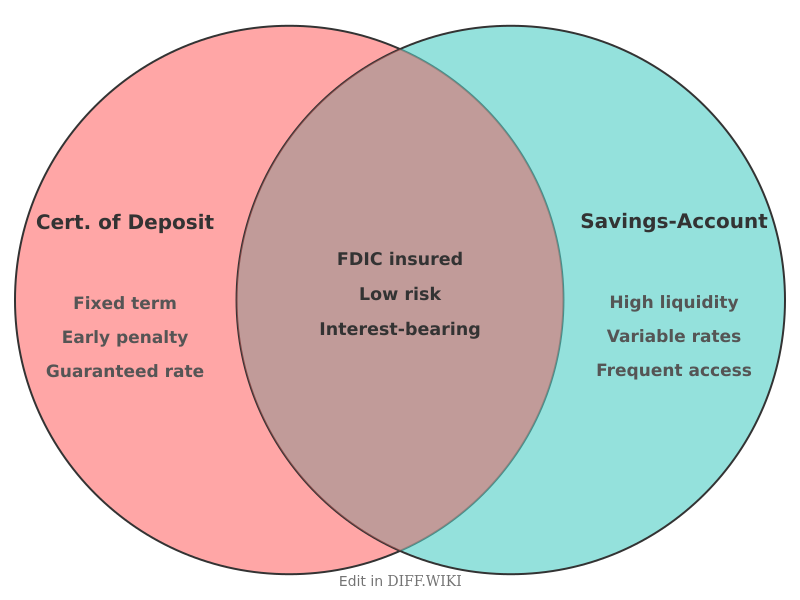

Certificates of deposit (CDs) and savings accounts are interest-bearing deposit accounts offered by banks and credit unions. In the United States, these accounts are typically insured by the Federal Deposit Insurance Corporation (FDIC) for banks or the National Credit Union Administration (NCUA) for credit unions up to $250,000 per depositor.[1] While both products provide a way to store cash while earning interest, they differ in terms of liquidity, interest rate structures, and withdrawal rules.

A savings account is a demand deposit that allows the account holder to deposit and withdraw money with high frequency. Historically, federal regulations such as Regulation D limited certain types of "convenient" withdrawals to six per month, though the Federal Reserve suspended this requirement in April 2020 to provide consumers with easier access to funds during the COVID-19 pandemic.[2] Interest rates on savings accounts are variable, meaning the financial institution can change the rate at any time based on market conditions or the federal funds rate.

A certificate of deposit is a time deposit. When an individual opens a CD, they agree to leave a specific amount of money in the account for a predetermined period, known as the "term." Terms generally range from three months to five years. In exchange for this commitment, the bank usually offers a fixed interest rate that is higher than the rate on a standard savings account. If the depositor withdraws the principal before the term ends, the bank assesses an early withdrawal penalty, which often equals several months of earned interest.[3]

Comparison table[edit]

| Category | Savings account | Certificate of deposit |

|---|---|---|

| Liquidity | High; funds are available for immediate withdrawal. | Low; funds are locked for the duration of the term. |

| Interest rate | Variable; rates fluctuate based on market conditions. | Fixed; the rate is locked at the time of deposit. |

| Withdrawal penalties | None (though monthly maintenance fees may apply). | Early withdrawal penalties typically apply. |

| Account term | No fixed term; the account remains open indefinitely. | Set term (e.g., 6 months, 12 months, 5 years). |

| Deposit requirements | Initial deposits are often small or zero. | May require a higher minimum opening deposit. |

| Best use case | Emergency funds and short-term expenses. | Targeted savings for a known future date. |

| Monthly access | Generally unlimited since 2020. | No access to principal until maturity without penalty. |

Rate environments and strategies[edit]

The choice between a CD and a savings account often depends on the current interest rate environment. In a rising rate environment, savings accounts allow depositors to benefit from higher rates immediately. In a falling rate environment, CDs allow depositors to lock in a higher yield before market rates drop.

Some depositors use a "CD ladder" strategy to balance liquidity and yield. This involves opening multiple CDs with different maturity dates. As each CD matures, the funds can be accessed or reinvested into a new CD, providing regular windows of liquidity while maintaining the higher fixed rates associated with time deposits.[4]

References[edit]

- ↑ Federal Deposit Insurance Corporation. "Your Insured Deposits." Accessed May 2024.

- ↑ Federal Reserve Board. "Federal Reserve Board announces interim final rule to amend Regulation D." April 24, 2020.

- ↑ Investopedia. "Certificate of Deposit (CD) vs. Savings Account: Which Is Better?" Updated February 2024.

- ↑ Consumer Financial Protection Bureau. "What is a certificate of deposit (CD)?" Accessed June 2024.