Differences between Bond and Stock

Contents

Stocks vs. Bonds[edit]

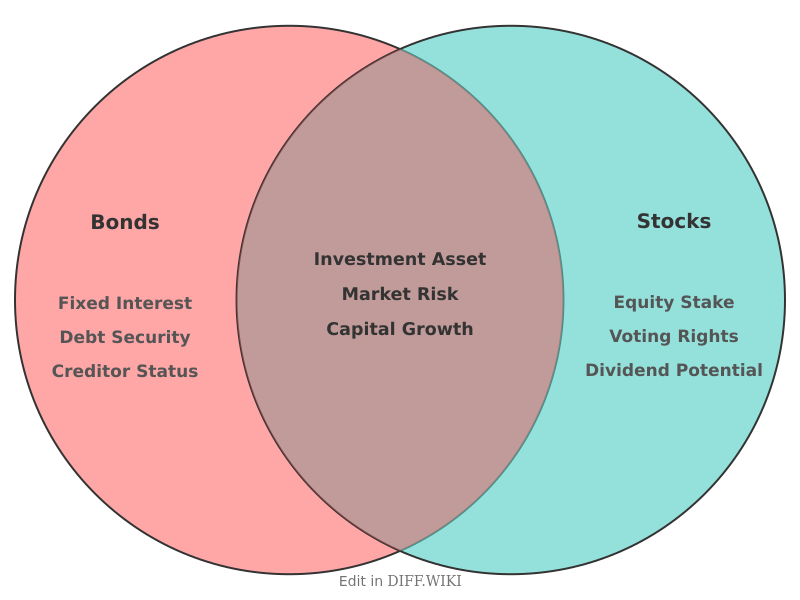

Stocks and bonds represent the two primary asset classes used by individuals and institutions to allocate capital in financial markets. While both serve as tools for entities to raise money, they differ in their legal structure, the relationship they create between the investor and the issuer, and their priority during a corporate liquidation. Stocks represent equity, or ownership, in a company. Bonds function as debt instruments, effectively acting as a loan from an investor to an issuer, such as a corporation or a government body.[1]

Comparison Table[edit]

| Category | Stocks | Bonds |

|---|---|---|

| Relationship | Ownership (Equity) | Lending (Debt) |

| Investor Status | Shareholder/Owner | Creditor |

| Primary Return | Capital gains and dividends | Interest (Coupon) payments |

| Maturity Date | None (Indefinite) | Fixed maturity date |

| Priority in Liquidation | Lowest (Residual claimants) | Higher (Paid before shareholders) |

| Voting Rights | Usually included for common stock | None |

| Market Volatility | Generally higher | Generally lower |

| Issuer Obligation | No legal requirement for returns | Contractual obligation to pay interest |

Ownership and Control[edit]

Purchasing shares of a company's stock grants an investor a portion of the equity in that business. Common stockholders often receive voting rights, which allow them to participate in the election of the board of directors and influence corporate policy. The value of this equity fluctuates based on the company's performance and market demand.[2]

Bondholders do not own any part of the issuing entity. Instead, they are creditors. A bond is a formal contract to repay borrowed money with interest at fixed intervals. Because bondholders are lenders, they do not have a say in the management of the company or voting rights on corporate matters. Governments often issue bonds to fund infrastructure or public services, whereas they do not issue stock.[3]

Risk and Return Profiles[edit]

The risk associated with stocks is tied to the success of the business. If a company fails, the stock price can drop to zero. However, stocks offer theoretically unlimited upside potential if the company grows. Returns are generated through price appreciation or dividends, which are distributions of profit.

Bonds are generally considered lower-risk investments because they provide a predictable stream of income through interest payments. The primary risks for bondholders include interest rate risk and default risk. Interest rate risk occurs when rising market rates cause the price of existing bonds to fall. Default risk is the possibility that the issuer will be unable to make the scheduled payments.

Liquidation Priority[edit]

The legal distinction between debt and equity becomes most apparent during bankruptcy or liquidation. Under the "absolute priority" rule, creditors are paid before owners. Secured bondholders have the highest claim on assets, followed by unsecured bondholders and other creditors. Stockholders are residual claimants and only receive funds if all other obligations have been fully satisfied.[4]

References[edit]

- ↑ Graham, Benjamin (2003). The Intelligent Investor. Harper Business. pp. 18–20. ISBN 978-0-06-055566-5.

- ↑ "Stocks". U.S. Securities and Exchange Commission. Retrieved 2025-05-14.

- ↑ "Bonds". Financial Industry Regulatory Authority (FINRA). Retrieved 2025-05-14.

- ↑ Bodie, Zvi; Kane, Alex; Marcus, Alan (2020). Investments. McGraw-Hill Education. pp. 45–47. ISBN 978-1-260-01383-2.