Differences between Bankruptcy and Foreclosure

Bankruptcy vs. Foreclosure[edit]

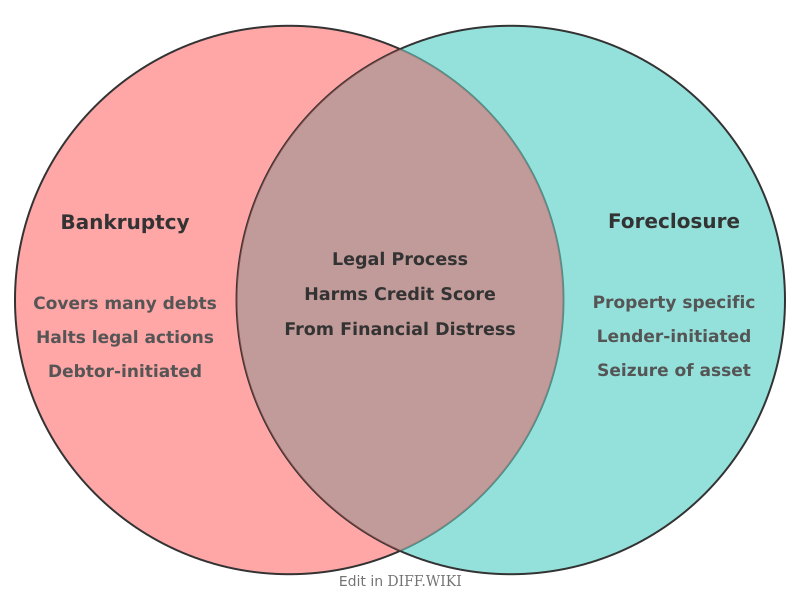

Bankruptcy and foreclosure are both legal processes that address significant debt, but they differ fundamentally in their scope, procedure, and consequences.[1] Foreclosure is a specific legal action taken by a lender to repossess a property when the borrower defaults on their mortgage payments.[2][3] In contrast, bankruptcy is a broader legal process initiated by a debtor who is unable to repay their debts, seeking relief that can affect multiple creditors and various types of debt.

Foreclosure is a remedy for lenders to recover the balance of a loan secured by a specific asset, most commonly real estate.[2] The process is initiated by the lender after the borrower misses a certain number of payments, and it can proceed either through the court system (judicial foreclosure) or outside of it (non-judicial foreclosure), depending on state law.[4][5] The ultimate outcome of a successful foreclosure is the sale of the property, with the proceeds used to pay off the mortgage debt.[3] This action specifically targets the property used as collateral for the loan.[2]

Bankruptcy, on the other hand, is a more comprehensive legal strategy for overwhelming debt.[1] An individual typically files for one of two common types: Chapter 7 or Chapter 13. Chapter 7, often called "liquidation bankruptcy," involves selling the debtor's non-exempt assets to pay off creditors. Chapter 13, or "reorganization bankruptcy," involves creating a court-approved plan to repay debts over a period of three to five years. Filing for bankruptcy triggers an "automatic stay," which immediately halts most collection actions, including foreclosure proceedings.[1]

While foreclosure directly results in the loss of the specified property, bankruptcy's effect on assets is more complex.[1] In a Chapter 7 bankruptcy, non-exempt assets may be sold, which could include a home. However, legal exemptions may protect a certain amount of equity in a primary residence. Chapter 13 bankruptcy is often used by individuals seeking to keep their homes, as it allows them to catch up on missed mortgage payments through the repayment plan.

Both actions have a significant negative impact on an individual's credit score. A foreclosure typically remains on a credit report for seven years. A Chapter 7 bankruptcy remains for ten years, while a Chapter 13 bankruptcy stays for seven years. Despite the potentially longer duration on a credit report, some lenders may view a bankruptcy that resolves multiple debts more favorably than a singular foreclosure.

Comparison Table[edit]

| Category | Bankruptcy | Foreclosure |

|---|---|---|

| Initiator | Typically initiated by the debtor (the person who owes money). | Initiated by the creditor (the lender).[2] |

| Scope of Debt | Addresses multiple types of debt, including credit cards, medical bills, and loans. | Specifically addresses the debt secured by the property being foreclosed on (e.g., a mortgage).[2][1] |

| Primary Goal | To obtain relief from overwhelming debt, either through liquidation of assets or a repayment plan. | For the lender to recover the amount owed on a defaulted loan by repossessing and selling the collateral property.[3] |

| Impact on Property | May allow the debtor to keep their home through a Chapter 13 repayment plan or if equity is protected by exemptions in Chapter 7.[1] | Results in the loss of the specific property that was used as collateral for the loan.[1] |

| Legal Process | A federal court process involving a petition, an automatic stay on collections, and either asset liquidation (Chapter 7) or a repayment plan (Chapter 13). | A state-specific legal process that can be either judicial (through the courts) or non-judicial, leading to the sale of the property.[4] |

| Effect on Other Assets | Can impact non-exempt assets, which may be sold to pay creditors in a Chapter 7 filing. | Generally does not directly affect other assets, unless the sale of the property results in a deficiency judgment. |

| Credit Report Impact | Remains on a credit report for 7 years (Chapter 13) or 10 years (Chapter 7). | Remains on a credit report for 7 years. |

References[edit]

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 "markbandylaw.com". Retrieved December 19, 2025.

- ↑ 2.0 2.1 2.2 2.3 2.4 "wikipedia.org". Retrieved December 19, 2025.

- ↑ 3.0 3.1 3.2 "investopedia.com". Retrieved December 19, 2025.

- ↑ 4.0 4.1 "investopedia.com". Retrieved December 19, 2025.

- ↑ "wikipedia.org". Retrieved December 19, 2025.