Differences between Checking Account and Savings Account

Contents

Checking account vs. Savings account

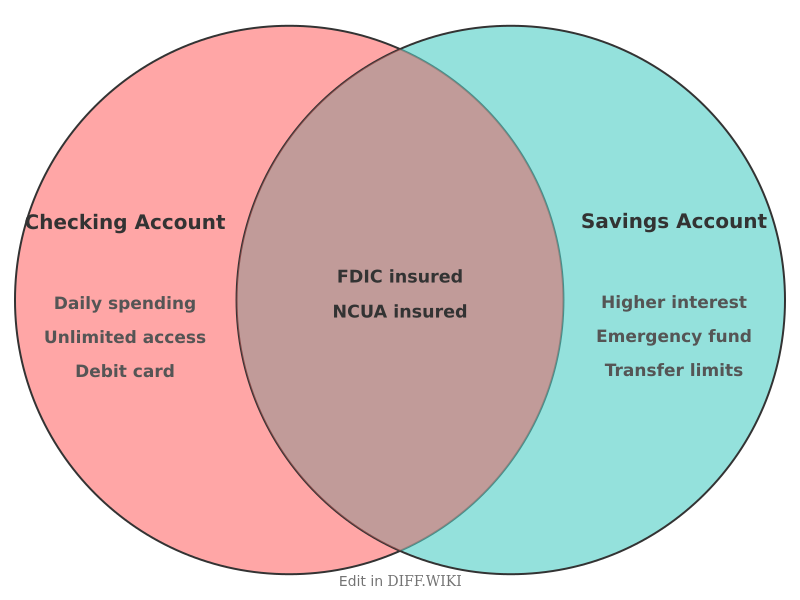

Checking and savings accounts are the two primary types of deposit accounts offered by retail banks and credit unions. While both provide a secure location for cash deposits insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), they differ in liquidity, interest-earning potential, and intended utility. Checking accounts are designed for frequent, short-term transactions, whereas savings accounts are intended for the accumulation of funds over a longer duration.[1]

Comparison Table

| Category | Checking Account | Savings Account |

|---|---|---|

| Primary Purpose | Daily transactions and bill payment | Wealth preservation and emergency funds |

| Interest Rates | Low or zero annual percentage yield (APY) | Higher APY compared to checking |

| Monthly Withdrawals | Generally unlimited | Historically limited to six; now varies by bank |

| Access Tools | Debit card, checks, ATM access | ATM card (sometimes), internal transfers |

| Direct Deposit | Primary destination for payroll | Often used for automated "pay-yourself-first" transfers |

| Minimum Balance | Often low or waived with direct deposit | May require a minimum to earn interest or avoid fees |

| FDIC/NCUA Insurance | Up to $250,000 per depositor | Up to $250,000 per depositor |

Checking accounts

Checking accounts serve as a transactional hub for personal finances. Funds in these accounts are considered highly liquid, meaning they can be accessed immediately via debit card purchases, automated teller machine (ATM) withdrawals, or electronic fund transfers. Most institutions offer online bill pay services and mobile check deposits specifically for checking accounts.

Because banks must maintain high liquidity for these accounts to meet frequent withdrawal demands, checking accounts typically offer little to no interest. Some "rewards checking" accounts exist, but these often require a specific number of monthly debit transactions to qualify for higher rates.[2]

Savings accounts

Savings accounts are interest-bearing instruments. Banks pay interest on these deposits because the funds are expected to remain in the account for longer periods, allowing the bank to use the capital for lending activities. High-yield savings accounts (HYSA), often provided by online-only banks, typically offer interest rates significantly higher than the national average.

Federal Reserve Regulation D previously mandated a limit of six "convenient" transfers or withdrawals per month from savings accounts. Although the Federal Reserve amended this regulation in 2020 to allow banks more flexibility, many financial institutions still enforce these limits or charge "excessive withdrawal fees" if a customer exceeds a specific number of monthly transactions.[3]

Both account types are subject to federal oversight. In the United States, the standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. This protection ensures that if a financial institution fails, depositors are reimbursed for their losses up to the legal limit.[4]

References

- ↑ Consumer Financial Protection Bureau. "What is the difference between a checking account and a savings account?" June 2023.

- ↑ Investopedia. "Checking Account: Definition, Types, and How They Work." Updated March 2024.

- ↑ Federal Reserve Board. "Federal Reserve Board announces interim final rule to amend Regulation D." April 2020.

- ↑ FDIC. "Your Insured Deposits." Updated January 2024.