Differences between RRSP and TFSA

Contents

Comparison Article

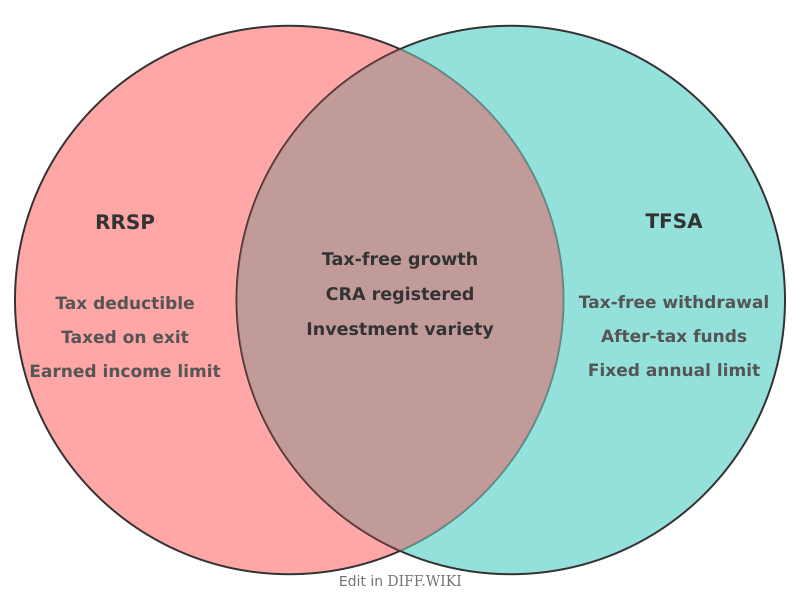

The Registered Retirement Savings Plan (RRSP) and the Tax-Free Savings Account (TFSA) are the primary tax-advantaged savings vehicles available to Canadian residents. While both accounts allow for tax-sheltered growth of investments, they differ in the timing of tax obligations, contribution eligibility, and the impact of withdrawals on government benefits. The RRSP was established in 1957 to assist Canadians in building retirement income through tax deferral. The TFSA was introduced in 2009 to provide a flexible savings option for both short-term and long-term goals.

Comparison of RRSP and TFSA

The selection between these accounts often depends on an individual's current income level relative to their expected income during retirement.

Comparison table

| Feature | Registered Retirement Savings Plan (RRSP) | Tax-Free Savings Account (TFSA) |

|---|---|---|

| Tax treatment of contributions | Tax-deductible (pre-tax income) | Not tax-deductible (after-tax income) |

| Tax treatment of withdrawals | Taxed as regular income | Tax-free |

| Annual contribution limit | 18% of earned income (up to a fixed annual cap) | Flat annual amount set by the government |

| Age limit for contributions | Until December 31 of the year the holder turns 71 | No age limit (must be 18 or older to start) |

| Impact on government benefits | Withdrawals may trigger clawbacks for OAS or GIS | Withdrawals do not affect income-tested benefits |

| Re-contribution of withdrawals | Contribution room is lost upon withdrawal | Withdrawn amount is added back to room the following year |

| Primary purpose | Long-term retirement savings | General-purpose savings (short or long term) |

Tax structure and eligibility

The fundamental difference between the two accounts is the timing of taxation. RRSP contributions result in a deduction from the contributor's taxable income for the year the contribution is made. This effectively provides an immediate tax refund or reduction in tax payable. However, all funds withdrawn from an RRSP—including the original principal and any investment growth—are taxed as income at the individual's marginal rate at the time of withdrawal.[1]

Conversely, TFSA contributions are made with after-tax dollars. There is no initial tax deduction. The advantage of the TFSA is that all future withdrawals, including capital gains, interest, and dividends, are entirely exempt from taxation. This makes the TFSA preferable for individuals who expect to be in a higher tax bracket when they withdraw the funds than they were when they contributed.[2]

Contribution limits and carry-forwards

For an RRSP, the annual contribution limit is determined by the individual's earned income from the previous year. For the 2024 tax year, the limit is 18% of the earned income reported on the 2023 tax return, up to a maximum of $31,560. Unused room carries forward indefinitely.

The TFSA limit is a flat dollar amount assigned to every eligible Canadian resident regardless of income. For 2024, the annual limit is $7,000. Like the RRSP, unused TFSA room carries forward. A unique feature of the TFSA is that any amount withdrawn from the account is added back to the individual's total contribution room on January 1 of the following calendar year. RRSP contribution room is not reinstated after a withdrawal.[3]

Impact on government benefits

RRSP withdrawals are recorded as taxable income. This increase in reported income can affect eligibility for income-tested government benefits. For seniors, large RRSP or Registered Retirement Income Fund (RRIF) withdrawals can result in a recovery tax (clawback) on Old Age Security (OAS) payments. TFSA withdrawals are not considered income and do not impact the calculation of benefits such as the Guaranteed Income Supplement (GIS), OAS, or the Canada Child Benefit.[4]