Differences between Corp and Inc.

Corp vs. Inc

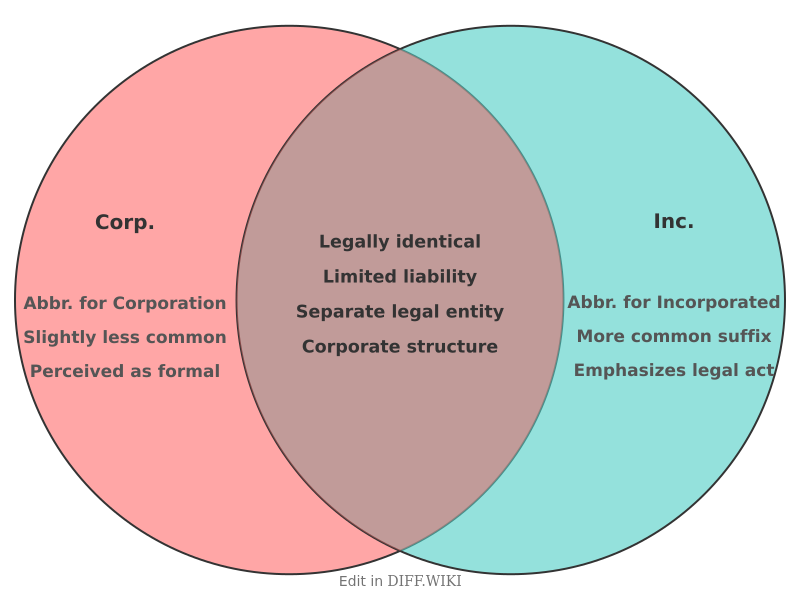

"Corp." and "Inc." are designators used in business names to indicate that the entity is a legally formed corporation.[1][2] "Corp." is an abbreviation for "corporation," while "Inc." is an abbreviation for "incorporated."[3][4] Both terms signify that the business is a legal entity separate from its owners, a process known as incorporation.[5] State laws require companies to include a corporate designator in their name to inform the public of their legal structure.[5][1]

From a legal and structural standpoint, there is no difference between a business that uses "Corp." and one that uses "Inc."[1][2] They share the same tax structures, compliance requirements, and limited liability protection for their owners (shareholders). The choice between the two is generally a matter of preference or branding. Once a business registers its name with one of the designators, it must use that specific choice consistently on all legal documents and official paperwork.

A primary function of forming a corporation is to create a legal distinction between the business and its owners. This structure provides shareholders with limited liability, meaning their personal assets are generally protected from the company's debts and legal liabilities.[3] Corporations are owned by shareholders, managed by a board of directors elected by those shareholders, and run day-to-day by officers appointed by the board.

Comparison Table

| Category | Corp. | Inc. |

|---|---|---|

| Full Term | Corporation | Incorporated |

| Primary Meaning | Refers to the business entity itself, structured as a corporation. | Refers to the fact that the business has undergone the legal process of incorporation. |

| Legal Status | Denotes a separate legal entity from its owners. | Denotes a separate legal entity from its owners. |

| Liability Protection | Provides limited liability for owners (shareholders). | Provides limited liability for owners (shareholders).[3] |

| Tax Structure | Identical to Inc.; entity is taxed separately from its owners (C Corp) unless an S Corp election is made. | Identical to Corp.; entity is taxed separately from its owners (C Corp) unless an S Corp election is made. |

| Interchangeability | Legally equivalent to Inc., but the chosen suffix must be used consistently after registration.[2] | Legally equivalent to Corp., but the chosen suffix must be used consistently after registration.[2] |

References

- ↑ 1.0 1.1 1.2 "stackexchange.com". Retrieved October 20, 2025.

- ↑ 2.0 2.1 2.2 2.3 "upcounsel.com". Retrieved October 20, 2025.

- ↑ 3.0 3.1 3.2 "doola.com". Retrieved October 20, 2025.

- ↑ "merriam-webster.com". Retrieved October 20, 2025.

- ↑ 5.0 5.1 "incnow.com". Retrieved October 20, 2025.